By Michał, May 27, 2024 · 15 min read

E-commerce Trends in Poland for 2024: Navigating the Digital Frontier

The e-commerce market in Poland is surging ahead, carving out a significant niche in the European digital economy landscape. Technological advancements and a robust online consumer base are key growth drivers.

Vital Statistics and Growth Trajectory

With a population exceeding 37 million, Poland boasts a tech-savvy society where 79% engage in online transactions. The average monthly expenditure on online purchases is 573 PLN. The e-commerce sector has seen a striking forecasted growth, from $11.72 billion in 2023 to an anticipated $20.46 billion by 2029, marking a 75% increase over six years.

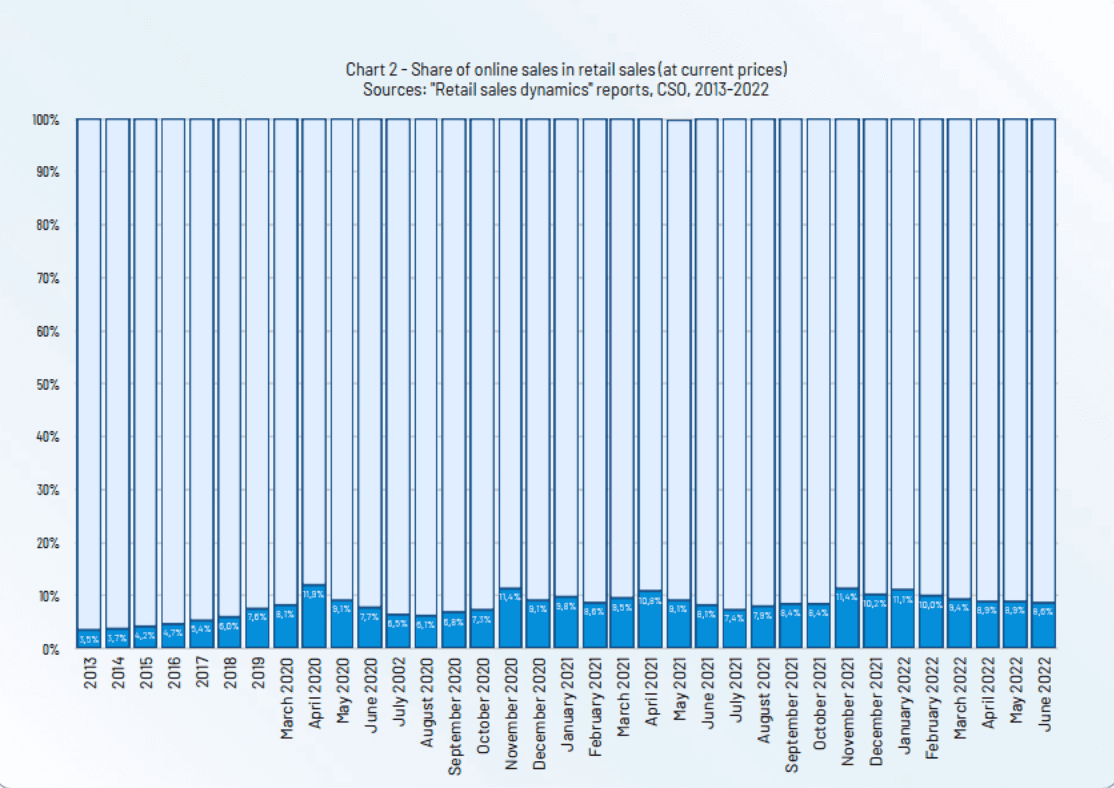

Chart analysis reveals that online sales fluctuate between 9-11% of the total retail market in Poland, based on monthly trends. In 2022, direct online store transactions accounted for 55% of online retail revenue, while marketplaces contributed 45%, showing a dynamic interplay between different e-commerce platforms.

Sources: Statista.com

Polish Online Shopping Preferences

The Polish e-shopper's cart is diverse, dominated by categories like:

- Clothing and accessories at 79%,

- Footwear making up 66%,

- Cosmetics and perfumes at 65%,

- Media such as books, CDs, films at 57%,

- Pharmaceuticals with 55%,

- Household appliances at 52%,

- and Sportswear rounding it out at 50%.

Source: Gemius ecommerce raport 2023

Poland's Booming E-commerce Landscape

E-commerce in Poland is not just growing-it's thriving. As one of the top three rapidly growing online retail markets in Europe, with substantial value potential, Poland sets the stage for a digital revolution in retail. With a diversified portfolio of products appealing to Polish consumers, e-commerce is poised to continue its upward trajectory in the coming years.

1. B2B E-commerce Growth: Navigating the Digital Frontier

In the dynamic landscape of commerce, the realm of business-to-business (B2B) e-commerce is witnessing remarkable growth, ushering in a new era of digital transactions and procurement methods. While business-to-consumer (B2C) e-commerce has traditionally held sway, recent years have seen a surge in the prominence of B2B e-commerce platforms in Poland, as businesses increasingly pivot towards digital channels for their procurement and sales needs.

According to the 2022 Deloitte B2B Commerce Report, the global B2B market saw a staggering 18% growth in the past year alone. This surge underscores the growing importance of digital platforms in facilitating transactions between businesses, with an emphasis on streamlining processes and enhancing efficiency.

The 2022 E-commerce Chamber Report provides further insights into the state of B2B e-commerce, revealing that globally, online B2B sales amounted to a staggering $7.72 trillion USD. Notably, by the end of 2021, B2B sellers in the USA had shifted their preference towards online sales over traditional methods, signaling a significant shift in the landscape of B2B transactions. However, despite the burgeoning growth of B2B e-commerce, challenges persist, with 52% of B2B buyers expressing frustration with the online purchasing process, leading 90% of them to switch suppliers due to negative experiences with e-commerce channels.

In the face of fierce global competition, the imperative for prioritizing digital transformation and embracing B2B e-commerce within local businesses is evident. Nearly 90% of companies with revenues exceeding 100 million PLN are engaged in B2B e-commerce, with the transportation/logistics/distribution and retail sectors emerging as the most active participants in this digital revolution.

The adoption of B2B e-commerce offers a myriad of benefits for businesses, ranging from increased customer value to enhanced automation and market expansion opportunities. By implementing B2B systems, companies can empower customers to repeat purchases, access real-time inventory and pricing information, and broaden their product offerings through dropshipping or cross-docking. Moreover, automation plays a pivotal role in streamlining processes, from generating warehouse and sales documents to facilitating order fulfillment, thereby alleviating the burden on employees and enhancing operational efficiency.

Furthermore, the advent of B2B e-commerce opens the door to new market opportunities, enabling businesses to tap into previously untapped customer segments and expand their market share. With the ability to cater to both B2B and B2C customers, companies can unlock new revenue streams and solidify their position in the digital marketplace.

Noteworthy Figures:

- Majority of companies that have implemented B2B e-commerce consider it a success (average rating of 3.86 on a scale of 1-5). The fashion industry stands out with a success rating of 4.15. Moreover, companies with revenues ranging from 6-10 million PLN are the most satisfied with the introduction of B2B e-commerce, rating it at 4.67.

- 41% of surveyed companies are already selling online (B2B).

- 88% of companies with existing online stores confirmed that they are optimized for mobile devices.

- 25% of companies indicated that 80% of their revenue comes from online channels.

- 49% of B2B e-commerce companies have been operating in the market for over 5 years.

- 95% of companies recognize the benefits of entering e-commerce, including increased sales (57%), growth in customer base (48%), expansion of product range (32%), increased purchase frequency (29%), reduced sales costs (27%), improved sales efficiency (24%), increased average purchase value (22%), and enhanced customer loyalty (21%).

Source: The 2022 E-commerce Chamber Report

2. Social Media Shopping

Social Media Ecommerce in Poland: An Emerging Trend with Unique Challenges

In recent years, the landscape of online shopping has significantly shifted towards social media ecommerce, integrating platforms like Facebook and Instagram into the broader ecommerce ecosystem. This integration allows users to browse and purchase products without leaving their favorite social media apps, creating a seamless blend of social networking and shopping.

Current Popularity and Trends

According to the 2023 Gemius Ecommerce Report, 19% of internet users in Poland engage in shopping via social media. This trend is most prominent among the youngest demographic, with 28% of users aged 15-24, and 23% of those aged 25-34. The popularity of social media shopping decreases with age.

The adoption of social media shopping is a relatively recent phenomenon, with 44% of the current shoppers having started within the last three years. The primary device for these purchases is smartphones, used by 77% of shoppers, highlighting the importance of mobile optimization for social commerce.

Shopping Behavior on Social Media

The interaction with brands on social media isn't just about browsing; it includes direct interactions with sellers for over half of the transactions. Other common methods include shopping on marketplace platforms, through sponsored ads or posts, and during live stream events. This variety in shopping avenues presents both opportunities and challenges for businesses.

Future Prospects and Limitations

Despite its growing popularity, the future of social media ecommerce presents a mixed picture. Most users anticipate maintaining their current level of shopping activity on social media, but a notable portion express intentions to decrease their spending via this channel. This sentiment may stem from lower satisfaction with social media purchases compared to other online or traditional shopping experiences.

Businesses also face specific challenges, including technological issues and limitations in integration with local delivery options like INPOST Paczkomaty and Orlen Paczka. Moreover, direct promotions on social platforms can sometimes dilute brand recognition, as customers may attribute their purchase to the platform (e.g., Facebook or Instagram) rather than the specific store.

Strategic Recommendations for Businesses

For optimal performance, businesses should consider using social media platforms to showcase products with a clear "buy now" button that redirects customers to their website. This approach not only ensures a smoother transaction process but also enhances opportunities for cross-selling and builds stronger brand loyalty and recognition. It's crucial for retailers to navigate the intricacies of social media shopping while maximizing the benefits of their online presence.

In conclusion, while social media ecommerce in Poland is certainly popular, especially among younger demographics, it comes with its set of challenges. Businesses need to strategically leverage this platform to enhance customer experience and increase brand loyalty, ensuring they remain competitive in this rapidly evolving market.

3. Eco-Friendly Initiatives

Sustainable E-commerce Trends in Poland

The Polish e-commerce sector is increasingly adopting sustainable practices amid heightened environmental awareness. A notable shift towards sustainable packaging reflects the industry's commitment to minimizing its ecological impact while catering to the growing demographic of eco-conscious consumers who consider sustainability a key factor in their purchasing choices.

Research indicates that environmental impact is a significant consideration for 42% of Polish consumers when it comes to delivery options. The most crucial element for respondents is the use of eco-friendly packaging, with 67% citing it as important, followed by the option for reusable packaging at 58%. Carbon footprint and the use of electric vehicles for transportation, however, are seen as less critical.

When evaluating the most eco-friendly delivery methods, 70% of consumers identified parcel lockers as the top sustainable option. Following this, 48% suggested partner collection points, and 47% favored store branch collection. Conversely, home or workplace deliveries via couriers were perceived as eco-friendly by only 37% of the respondents.

Understanding and interest in sustainable development (SD) among Polish consumers are on the rise, but progress is gradual. About 13% of consumers understand the term SD as it pertains to business responsibility. While selecting an e-commerce platform, factors such as price, product range, promotions, and delivery methods prevail. Yet, 35% of e-shoppers consider sustainable development, with this figure jumping to 50% when it involves the actual product selection online.

To promote more responsible online shopping and mitigate return rates, consumers highlight the need for accurate descriptions, quality images, and detailed product composition information. Despite this, the majority still overlook the environmental impact of e-commerce returns, with only 61% considering the ecological aspect of product packaging and a mere 28% willing to pay more for eco-friendly packaging options.

Intriguingly, the “Responsible e-commerce 2022” report reveals that Polish consumers rate their national e-commerce market as more socially responsible than that of the European Union (scoring 4.08 versus 3.84 on a 6-point scale). In terms of ecological performance, intercontinental markets rank lowest at 3.58, suggesting there's significant room for global improvement in sustainable e-commerce practices.

4. Real-Time Pricing - dynamic reprices the best solution for your market opponents

Dynamic pricing powered by artificial intelligence (AI) is revolutionizing the way prices are determined in e-commerce. By analyzing market trends, competitor pricing, and consumer behavior in real-time, AI algorithms can adjust prices dynamically to optimize sales and maximize profitability for online retailers. In the contemporary e-commerce landscape, the key to staying competitive lies in dynamic pricing strategies. The power of real-time pricing isn't just about keeping up with competitors; it's about staying one step ahead. Retailers now have the power to wield price optimization as a strategic tool, reshaping their approach to market demands and customer behavior with unparalleled agility.

Dynamic pricing, at its core, is the automated adjustment of prices in response to real-time market factors. It's a vital component for any retailer in today's digital economy, where prices can shift momentarily based on a myriad of triggers. AI-powered price optimization tools are revolutionizing how retailers can respond to market changes, consumer trends, and competitive pressures. It's about delivering the right price at the right time-every time.

Leveraging sophisticated data analytics and machine learning algorithms, these tools enable retailers to analyze vast quantities of data, from historical sales figures and market trends to competitor pricing strategies. This comprehensive insight allows for granular pricing adjustments, ensuring prices are optimized for every scenario-whether that's a sudden shift in consumer demand or a change in supply chain dynamics. Furthermore, the convergence of dynamic pricing with demand forecasting means inventory levels can be managed with precision, minimizing stockouts and excess stock.

Personalized pricing also plays a pivotal role. By delivering tailored prices and promotions, retailers can enhance customer loyalty and drive repeat business. Agile promotion management further amplifies the efficacy of marketing campaigns, allowing for adjustments in real time based on immediate consumer response.

Real-time pricing adaptability enables retailers to swiftly adjust their product assortment, using AI to suggest personalized product combinations. Dynamic pricing strategies culminate in the maximization of profit margins by allowing retailers to adjust prices in response to supply and demand dynamics.

In conclusion, the age of real-time pricing is upon us, heralding a new era where price optimization software is not just desirable but indispensable for retail success. Retailers armed with these sophisticated tools can look forward to not just surviving but thriving in the fiercely competitive and ever-evolving e-commerce battlefield.

5. Subscription Shopping

Subscription Shopping in Poland: A Strategy for Customer Loyalty and Increased Sales

Subscription-based shopping, a dominant trend in Western countries, is gaining momentum in Poland. Although physical product subscriptions are less widespread in Poland, some companies already offer monthly subscriptions, reflecting a growing shift as Polish consumers begin to see the value in this convenient shopping model. For example, attractive sample packs of cosmetics have captured the hearts of many internet users. The Polish version of beGLOSSY boxes, available through a monthly subscription, is aimed at young women who want to use a variety of cosmetics but do not want to buy them all.

Allegro Smart is a testament to the rising popularity of subscription services in Poland. For a monthly fee, users enjoy perks such as free delivery and returns. The impact of this service is significant—Allegro reports having 5 million users for Smart, and these subscribers purchase items 2.5 times more often than non-subscribers. This uptick in purchasing frequency underscores the subscription model's potential for driving customer engagement and sales.

Another leading player is Empik Premium with a 9,5 mln of users Premium and Premium Free, offering tangible benefits for a monthly subscription. Customers enjoy free delivery for certain orders, a 15% in-store discount on a diverse product range, and up to 20% off selected online products. These incentives are strategically designed to boost both online and in-store purchases, creating a comprehensive retail experience.

For large online stores with thousands of daily orders, adopting a subscription model similar to Allegro Smart or Empik Premium can be a lucrative move. Offering benefits like free delivery or exclusive discounts for a nominal monthly fee can significantly increase order volume. Free delivery, especially, is a compelling offer that can attract a substantial customer base, leading to a steady stream of orders.

The key to success with subscription services in Poland lies in understanding and leveraging customer behavior. Free shipping is a major drawcard, as indicated by the impact of Allegro Smart's offering. Additionally, exclusive discounts and the convenience of subscription shopping encourage repeat purchases and can elevate a regular customer to a loyal brand advocate.

Polish e-commerce platforms considering a subscription model should look to these success stories for inspiration. By offering value that extends beyond the transaction—through savings, convenience, and a tailored shopping experience—retailers can harness the power of subscription services to build a loyal customer base and increase their market share in Poland's evolving digital economy.

How to Start an Online Store in Poland?

6. One-Day Delivery

The e-commerce arena in Poland is rapidly evolving, and with it, consumer expectations are skyrocketing. The need for speed is more critical than ever, with the Polish online shopping sphere witnessing a surging demand for one-day delivery services. These fast delivery options are not merely a luxury but a driving force behind the decision to click 'purchase'.

Gemius - E-commerce report 2023

Statistics show that a staggering 94% of online shoppers are motivated by delivery times of up to 8 hours, while a significant 83% are prompted by 12-hour delivery promises. This suggests that the quicker the delivery, the higher the likelihood of consumers frequenting an e-commerce platform. With only 26% of shoppers motivated by 24-hour delivery, it's clear that 'the need for speed' is not just a catchphrase but a tangible consumer demand.

Moreover, free delivery stands as a robust motivator, with 54% of those surveyed indicating it would encourage them to shop online more frequently. This motivation increases with the value of the purchase, highlighting that offering free shipping is not just a strategy for customer retention but also a catalyst for higher-value sales.

In this swiftly changing e-commerce landscape, Polish retailers are stepping up their game by providing dynamic, real-time information about product delivery times on their websites and during the checkout process. The ability to place orders as late as 23:59 for next-day delivery to parcel lockers or specific addresses is now a game-changer, setting the standard for competitors.

To support such ambitious delivery promises, full automation of warehouse processes is key. The implementation of Warehouse Management Systems (WMS), along with the integration of e-commerce platforms with WMS and Enterprise Resource Planning (ERP) systems, streamlines the efficiency of picking, packing, and shipping, as well as receiving and storing goods. Optimal routing for pickers in the warehouse can significantly reduce preparation time for orders, boosting productivity.

But efficiency is not the only advantage. Increased customer satisfaction from being dynamically informed about the real-time status of their orders results in more positive reviews, fostering a cycle of trust and repeat business. Satisfied customers are likely to become loyal patrons, knowing they can rely on swift and accurate service.

For local delivery options, retailers are going beyond national carriers, offering convenient alternatives not available with international courier services, such as delivery to local parcel machines like InPost Parcel Lockers or Orlen Package. For businesses outside Poland, partnering with companies like Global24 or OlzaLogistics can bridge the gap, providing cross-border delivery with local operators and even potentially faster delivery than international couriers.

Conclusion

In conclusion, the integration of technological innovation, a deep understanding of changing consumer behaviors, and an emphasis on sustainability are shaping the future of e-commerce in Poland. As businesses align with these trends and embrace digital advancements, they are well-positioned for success in the dynamic world of Polish e-commerce in 2024 and the years to follow.

Thinking about consulting with a Fractional E-commerce Manager? They offer specialized guidance for the Polish market, helping your online store grow from start to finish.

Would you like to innovate your ecommerce project with Hatimeria?

For 20 years, he has been deeply involved in e-commerce, managing projects and helping businesses succeed on platforms like Shopify, Magento, AtomStore, and Baselinker. As a consultant, he has assisted companies entering Poland's e-commerce market. He also owns Mikesport, a respected brand he founded, known for quality and innovation in e-commerce.

Read more Michał's articles